the DLC difference.

Pre-Positioning

Our pre-positioning process is designed to enhance your home buying journey, ensuring it's as seamless as can be. Here are the key advantages it offers:

Pre-Qualification

We kick things off by evaluating your financial situation and determining the maximum mortgage you will qualify for, so you understand your purchasing power right from the start.

Rate Hold

We lock in a favorable interest rate to protect your budget throughout the home buying process.

Budget

We will pre-qualify you for the maximum the banks will lend to you but sometimes this can be higher than you want to spend. Let us know your budget for your monthly mortgage payment and we can let you know which home price will work for you.

Closing Cost Estimates

Get upfront estimates of your closing costs, ensuring you're well-prepared for this essential step.

Faster Processing with an Accepted Offer

Once you've found your dream home and your offer is accepted, our pre-positioning process speeds up the mortgage approval, reducing the stress of making your condition and closing dates.

Pre-Approval Letter for Your Realtor

Equip your realtor with a pre-approval letter, making your offers more competitive in the market.

Coaching

If there is anything in your credit or financials that could affect qualifying for a mortgage, we can address this early and make a plan to resolve before you make an offer on a home.

Get to Know One Another

Building a strong client-advisor relationship is important to us. Let's get to know each other!

Purchasing

Ready to purchase a home? We're here to support you every step of the way.

- First-Time Buyers: Starting your homeownership journey? We offer guidance so you feel confident purchasing your first home.

- Self-Employed: Flexible financing solutions to support business owners.

- New to Canada: Navigating the Canadian real estate market as a newcomer? Our expertise ensures a smooth transition.

- Experienced Buyers: For those who've been down this road before, we're here to enhance and simplify your purchase process.

- Second Home Purchase: Explore financing options for your investment property or vacation home.

- Purchase Plus Improvements: Discover how to finance your dream home and renovation projects all in one.

- Buying for Family: Did you know you can purchase a home for family with as little as 5% down payment? Kids going to post-secondary? Want to help aging parents? We are here to assist.

Investment Properties

Our investment property mortgage services are here for both rookie investors and seasoned pros aiming to grow their portfolio.

- Refinance for a new home and gain rental income: Have you considered converting your existing home into a rental and purchase a new home to live in? Ask us how.

- Qualifying for a rental property mortgages: As your investment portfolio expands, navigating qualification requirements can become more complex. Qualifying criteria varies significantly among lenders, making it important to partner with a knowledgeable mortgage expert who understands the diverse qualification processes of different lenders.

Mortgage Renewals

Do you have a mortgage renewal coming up? Before you lock into another term with your current lender let us look into your options.

- Timing: Did you know that we can lock in a rate for you as early as 120 days before your current term ends?

- Maximize your savings: We will shop the mortgage market to find you the deal for you.

- Financial check in: Is the mortgage product and term offered by your current lender still the right choice for your circumstances? Let's find out. Renewal time is the best time to make a change to your mortgage.

Refinancing

Refinancing is when you replace your current mortgage with a new mortgage to get better terms or to access equity in your home. There are a number of reasons you may consider a refinance including:

- Consolidating debt: We are happy to run an analysis to determine your interest savings and to see how we can improve your cashflow by consolidating your consumer debt into your mortgage.

- Investing: Starting a business? Buying a new home? Investment opportunities? Want to renovate? Consider a refinance to access equity you have in your property.

- Lower your mortgage payments: Feeling cash strapped? Has your variable mortgage increased to the point where your mortgage payments are unmanageable? We can look at refinancing to lower your mortgage payments.

- Pre-retirement planning: Homeowners in Canada often have a considerable amount of wealth tied up in their homes. Before retiring, explore the option of refinancing to secure a Home Equity Line of Credit, allowing you to access your home equity during retirement while you're still eligible based on your employment income.

- Refinance for Divorce: Did you know there is a special Spousal Buyout mortgage product? The spousal buyout program is different from a traditional refinance because it allows you to access 95% of your home's equity instead of the traditional 80%. The program allows the following to be included in the mortgage: Equity Payout to ex-spouse, Matrimonial Debt, Mortgage Penalty, Legal fees.

Reverse Mortgage

Canada offers a variety of reverse mortgage lenders, each with their own range of reverse mortgage products. Instead of calling a generic 1-800-number, reach out to our team for unbiased information and advice.

Ways clients use Reverse Mortgages:

- Handle unexpected expenses

- Reduce financial stress

- Increase your monthly cash flow

- Consolidate debt

- Buy another property

- Cover medical expenses

- Renovate your home

- Take a much needed vacation

- Help out children

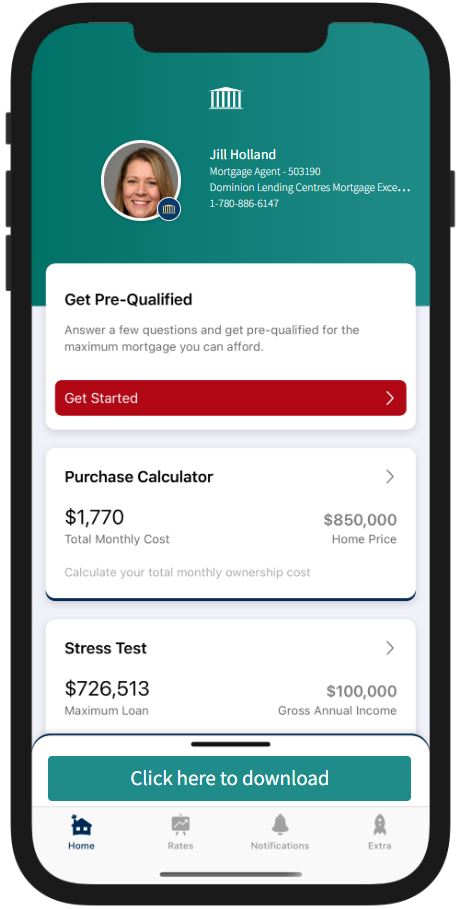

Download Our Mortgage Toolbox App

Calculate Your Total Cost of Owning A Home

Estimate The Minimum Down Payment You Need

Calculate Land Transfer Taxes And The Available Rebates

Calculate The Maximum Loan You Can Borrow

Stress Test Your Mortgage

Estimate Your Closing Costs

Compare Your Options Side By Side

Search For The Best Mortgage Rates

Email Summary Reports (PDF)

Use Our App In English, French, Spanish, Hindi And Chinese

Other Services

Equipment Leasing

Have you considered Equipment Leasing for your Business? Some of the benefits are:

- Lower monthly payments can be easier to manage that the upfront cost of purchasing equipment.

- Expensing monthly lease payments compared to purchasing and depreciating the capital cost of equipment over years can be a tax strategy - consult your accountant.

Industries that can benefit from leasing

- Automotive and vehicles

- Construction

- Dental Equipment

- Energy Retrofits

- Landscaping

- Media and Photography

- Medical Equipment

- Office Equipment

Technology