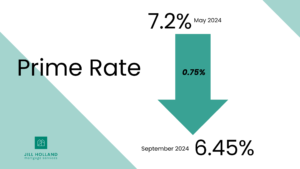

On September 4th, the Bank of Canada (BoC) announced a significant change: the Prime rate has been lowered by 0.25%. While this may seem like a small adjustment, it’s a move with big implications for homeowners, borrowers, and the Canadian economy. The Bank Prime rate, which reached a peak of 7.2% in May 2024, is now down to 6.45%. This is the 3rd consecutive decrease and we are loving the trend!

This shift is particularly important for those with variable-rate mortgages and revolving lines of credit, as their payments are directly influenced by changes in the Prime rate. Let’s dive into what this means for your mortgage, why the BoC made this decision, and how you can benefit.

What Does This Mean for Mortgages?

Fixed Rates: A Potential Drop in Rates

Although fixed mortgage rates aren’t directly tied to the Bank of Canada’s Prime rate, the recent decrease is still promising news for those considering fixed-rate mortgages. Fixed rates are influenced more by bond markets and other economic factors, but a lower Prime rate can create a favorable environment for these rates to decline as well. To give you some context, insured 5-year fixed mortgage rates have already dropped from a high of 5.94% in October 2023 to around 4.64% today. If you’re thinking about locking in a fixed rate, now could be an opportune moment to explore your options, as we may see even more downward movement in the coming months.

Variable Rates: Immediate Benefits

If you have a variable-rate mortgage, this rate cut is excellent news. Unlike fixed rates, variable rates are directly affected by changes in the Prime rate, meaning the impact on your mortgage payments can be immediate. There are two main types of variable-rate mortgages:

- Static Payment Variable: With the BoC’s decision to lower the Prime rate, your monthly payment remains unchanged. However, more of your payment will now go toward paying down the principal rather than interest, helping you build equity in your home faster. This is a significant advantage, as it means you’re effectively paying off your mortgage more quickly without increasing your monthly expenses.

- Adjustable Rate Mortgage: For those with adjustable-rate mortgages, you’ll see an immediate decrease in your monthly payments. For every $100,000 you owe, your payment will drop by approximately $15 per month with this cut and down about $45/ month since the first rate cut in June 2024. This reduction may seem modest, but over time, it can lead to substantial savings and provide more flexibility in your budget.

Why Did the Bank of Canada Lower the Prime Rate?

You might be wondering why the BoC decided to lower the Prime rate now. The decision was influenced by several key factors that highlight the current state of the Canadian economy.

- Inflation: Signs of Control

Inflation has been a driving force behind the BoC’s monetary policies over the past year. As of July, Canada’s annual inflation rate had fallen to 2.5%, down from 2.7% in June. This is a crucial development, as it indicates that the BoC’s efforts to curb inflation are paying off. With inflation now within their target range, the BoC is more comfortable easing interest rates to support economic growth. Lower rates can help stimulate spending and investment, which are essential for a healthy economy.

- Retail Numbers: Boosting Consumer Confidence

Recent retail sales data shows that Canadian consumers are feeling the pinch of high interest rates, with spending on the decline. This slowdown in consumer activity is a concern for the broader economy, as retail sales are a key driver of growth. By lowering the Prime rate, the BoC aims to alleviate some of the financial pressure on consumers, encouraging them to spend more freely. This, in turn, could help revive retail activity and provide a much-needed boost to the economy.

- Labor Markets: Supporting Job Creation

The labor market is another area of concern. In July, Canada lost 2,800 jobs, and the unemployment rate held steady at 6.4%, the highest level in over two years. A weakening job market can lead to reduced household spending, further slowing economic growth. By lowering interest rates, the BoC hopes to support job creation and stabilize the labor market. Lower borrowing costs can encourage businesses to invest in expansion and hiring, which are critical for sustaining economic momentum.

- US Rate Outlook: Rate cuts are coming

The US Federal Reserve is expected to start cutting rates soon, likely as early as September. Some might worry that Canada lowering rates ahead of the US could weaken our currency or economy. However, with two interest rate cuts ahead of the US, our Canadian dollar has stayed stable.

What’s Next? How to Make the Most of This Opportunity

The Bank of Canada’s decision to lower the Prime rate presents a unique opportunity for homeowners and potential buyers. Whether you’re considering a fixed or variable-rate mortgage, now is the time to assess your options and take advantage of the favorable conditions.

If you have any questions about how this rate cut could impact your mortgage or if you’re curious about your refinancing options, I’m here to help. As a mortgage broker with years of experience and a deep understanding of the market, I can guide you through the process and ensure you make informed decisions that align with your financial goals.

Plus, don’t miss the chance to hear from Dominion Lending Economist Dr. Sherry Cooper, who explains the BoC’s decision and its implications for the real estate market.

” I think the Bank of Canada will not stop easing monetary policy until the overnight rate is 2.75% which will occur by the end of next year” -Dr. Sherry Cooper

The Bank of Canada’s recent rate cut is a welcome development for anyone with a mortgage or considering purchasing a home. With the Prime rate now at 6.45%, there’s potential for savings and better mortgage terms. Whether you’re looking to refinance, purchase, or simply explore your options, this is an exciting time to take action.

You can also follow me on social media for more updates and tips or start a mortgage application with me today.

Let’s navigate this opportunity together and find the best mortgage solution for you!

Hi, I’m Jill, your mortgage pro. I am here to make the world of mortgages less confusing so you can feel confident in your financial decisions. Through my blog, I aim to provide you with the knowledge and guidance you need to make informed decisions. Your financial peace of mind is my top priority.