Choosing the right mortgage term is one of the most important decisions you’ll make when purchasing or refinancing your home. Your mortgage term doesn’t just determine how long you’re locked into your loan agreement; it also impacts your interest rates, monthly payments, and overall financial flexibility.

In this blog, we’ll explore the key considerations when selecting a mortgage term, breaking it down into manageable steps so you can confidently make the choice that aligns with your financial goals and lifestyle.

What Is a Mortgage Term and Why Does It Matter?

A mortgage term is the length of time your agreement with your lender is in effect. Common terms range from one to five years in Canada, but longer terms may also be available.

Here’s why it’s important:

- Interest Rate Security: Your fixed rate mortgage term locks in your interest rate for the duration of the term. This can offer peace of mind or, if rates drop, leave you wanting more flexibility.

- Financial Planning: Knowing your term helps you plan your budget and savings. Shorter terms often come with higher rates but more flexibility, while longer terms provide stability.

- Renewal Opportunities: At the end of your term, you’ll need to renew your mortgage. This is an opportunity to reassess your financial needs and explore other lenders or terms.

Understanding the basics of mortgage terms is the foundation for making an informed choice.

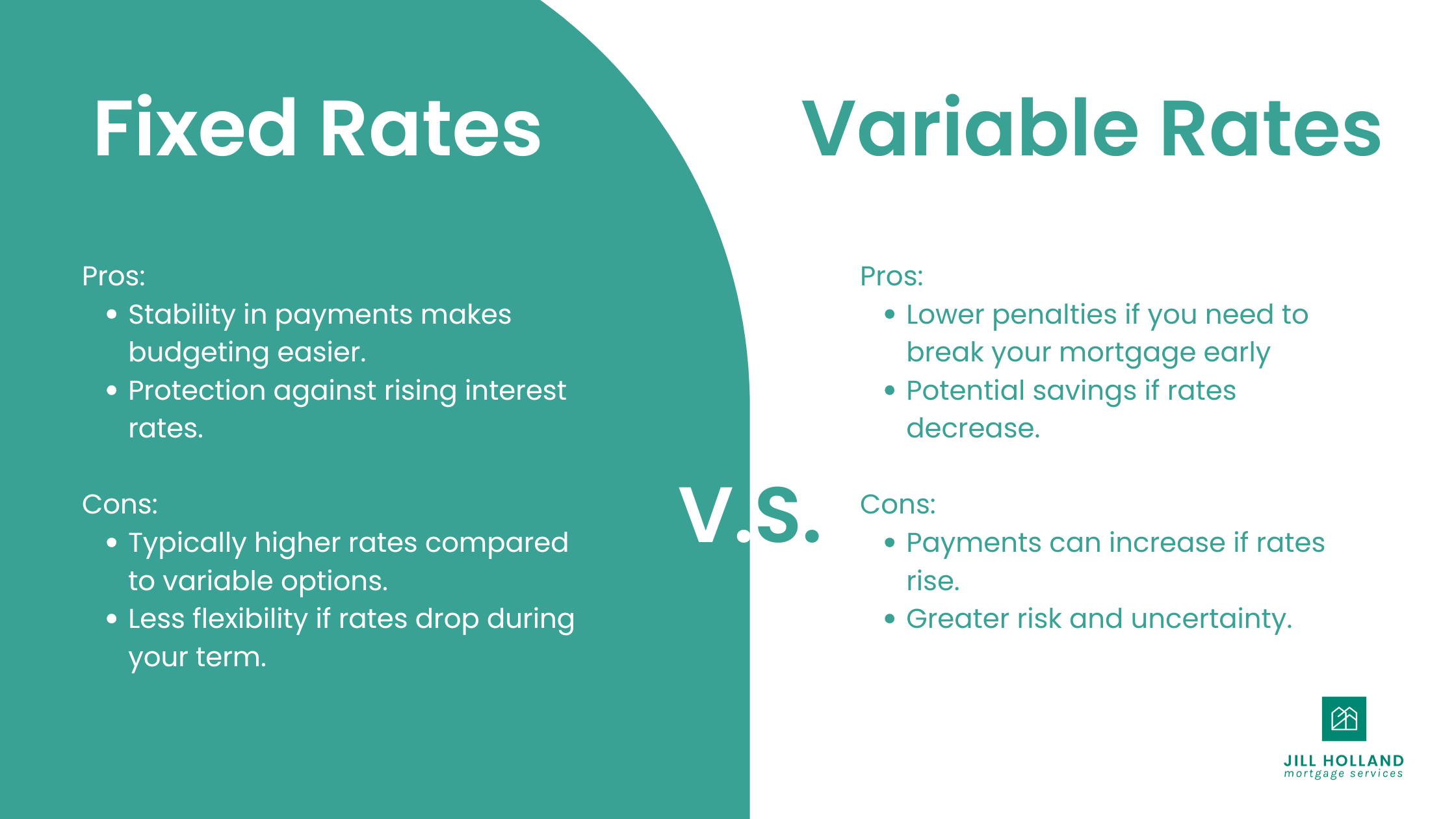

Fixed vs. Variable Rates: Which Is Right for You?

One of the first decisions you’ll face is choosing between a fixed or variable interest rate. Each has its pros and cons, depending on your financial situation and risk tolerance.

Fixed Rates

Fixed-rate mortgages lock in your interest rate for the term of your mortgage. This means your monthly payments remain consistent, regardless of changes in market rates.

Pros:

- Stability in payments makes budgeting easier.

- Protection against rising interest rates.

Cons:

- Typically higher rates compared to variable options.

- Less flexibility if rates drop during your term.

Variable Rates

Variable-rate mortgages fluctuate based on the lender’s prime rate, which is tied to the Bank of Canada’s interest rate. Your payments may vary or remain fixed with changes in interest allocation.

Pros:

- Lower penalties if you need to break your mortgage early

- Potential savings if rates decrease.

Cons:

- Payments can increase if rates rise.

- Greater risk and uncertainty.

When deciding between fixed and variable rates, consider your comfort level with risk and your long-term financial goals.

Short-Term vs. Long-Term Mortgages: What’s the Difference?

Another critical factor in choosing a mortgage term is deciding between a short-term or long-term agreement. Both options have unique advantages depending on your financial needs and plans.

Short-Term Mortgages

Short-term mortgages, typically one to three years, offer more flexibility for those expecting life changes or shifts in the market.

Best for:

- Those planning to sell, move, or refinance soon.

- Those confident in a potential drop in interest rates.

Pros:

- Easier to adjust your mortgage strategy after the term ends.

Cons:

- More frequent renewals can bring uncertainty.

- Potential rate increases at renewal.

Long-Term Mortgages

Long-term mortgages, often five years or more, provide stability and predictability, making them ideal for homeowners seeking consistency.

Best for:

- Homeowners planning to stay in their home long-term.

- Those who prioritize stability over potential rate fluctuations.

Pros:

- Stable interest rates for longer periods.

- Simplifies long-term financial planning.

Cons:

- Higher penalty risk for breaking the mortgage early.

When choosing your term length, think about your future plans and how much flexibility you might need.

Let an Expert Guide You

Choosing the right mortgage term can seem daunting, but with the right guidance, it becomes a manageable and rewarding decision. Whether you’re debating fixed vs. variable rates, or short-term vs. long-term options, the best choice is the one that aligns with your financial goals, lifestyle, and risk tolerance.

As a seasoned mortgage expert, I’m here to help you navigate these decisions and secure the best possible terms for your needs. Let’s work together to unlock the door to your dream home and financial future.

Hi, I’m Jill, your mortgage pro. I am here to make the world of mortgages less confusing so you can feel confident in your financial decisions. Through my blog, I aim to provide you with the knowledge and guidance you need to make informed decisions. Your financial peace of mind is my top priority.