As part of Canada’s 2024 budget, the government has extended amortization periods for insured mortgages to 30 years, effective August 1, 2024. This extension is available to first-time buyers purchasing newly constructed homes. The strict criteria for this program significantly limits the number of buyers it will assist, but it will be beneficial for some.

Key Details:

- Eligibility:

- Applies to insured loans with down payment amounts between 5% and 19.99%

- Available for new purchases from August 1, 2024.

- First-Time Home Buyer Definition:

- Never purchased a home before, or

- Not occupied a home as a principal residence in the last four years, or

- Recently experienced the breakdown of a marriage or common-law partnership.

- Property Requirements:

- Purchase price must be less than $1 million.

- Must be newly built and owner-occupied or partially owner-occupied.

- Can have 1-4 units.

- Cost:

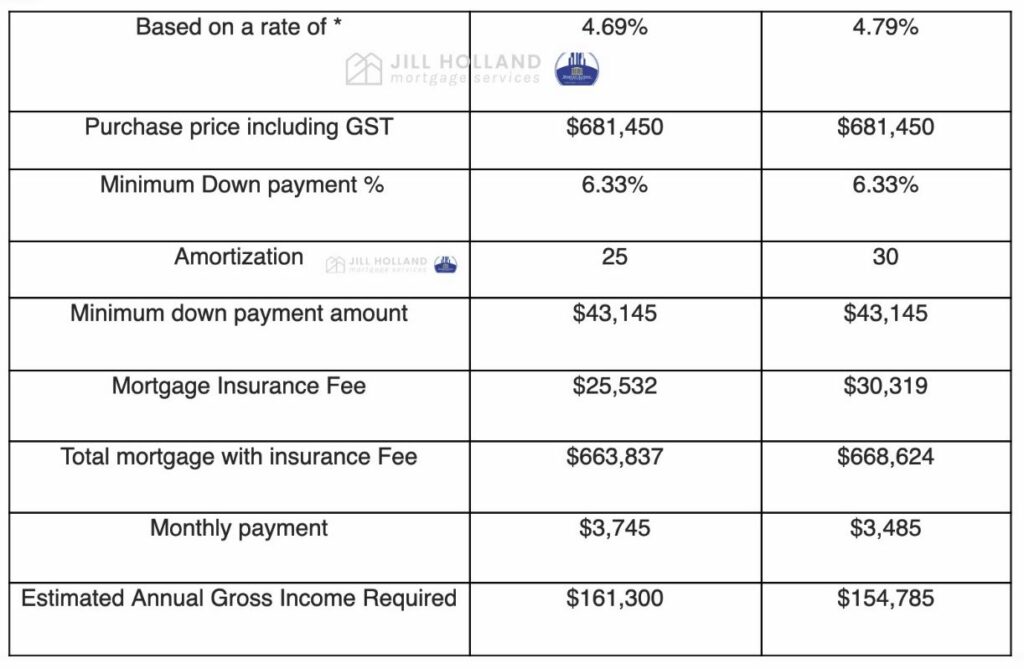

- 0.20% insurance premium surcharge for loans with amortization periods greater than 25 years.

- Lenders may apply a rate premium of about 0.10%.

Benefits:

- Lower Monthly Payments: Easier to manage your budget.

- Increased Access to Housing: Slight increase in borrowing power can help purchase homes that were previously just out of reach.

- Support for Newly Built Homes: Encourages the development of new housing stock.

Impact on Affordability and Borrowing Power:

The 30-year amortization period reduces monthly mortgage payments, making the payment more affordable but this savings may not justify the higher long-term interest costs of taking on the longer amortization. Longer amortization can also marginally increase borrowing power allowing borrowers to qualify for more, which can be crucial for first-time buyers in competitive markets.

Considerations

While beneficial, a longer amortization period means paying more interest over the life of the loan. It’s essential to weigh the benefits of lower monthly payments against the overall cost of borrowing.

Conclusion

The extension of amortization periods to 30 years for first-time home buyers purchasing newly built homes is a positive step towards improving housing affordability in Canada. It offers immediate relief with lower monthly payments and slightly increased borrowing power. However, always consider your long-term financial goals and consult with a mortgage professional to determine the best strategy for your situation.

If you have any questions about the new 30-year amortization or need assistance with your mortgage needs, feel free to reach out. We’re here to help you navigate these changes and find the best solutions for your home-buying journey.

Hi, I’m Jill, your mortgage pro. I am here to make the world of mortgages less confusing so you can feel confident in your financial decisions. Through my blog, I aim to provide you with the knowledge and guidance you need to make informed decisions. Your financial peace of mind is my top priority.