The Canadian mortgage landscape is evolving, and exciting changes are on the horizon. Effective December 15th, new mortgage rules will be implemented that could open the doors for both first-time homebuyers and those looking to invest in new builds. These updates have the potential to make homeownership more accessible and affordable. Let me break down the key changes, how they may impact you, and what you need to consider as you navigate the home-buying process.

Introduction to the New Mortgage Rules

The Canadian mortgage industry is one of the most regulated in the world, and it’s no surprise that the rules governing home financing are continuously evolving to meet the needs of the market. These new regulations, set to take effect in December 2024, bring significant changes to how much home buyers can borrow, how long they can spread their payments, and who qualifies for specific programs. Whether you’re a first-time buyer or a seasoned homeowner, these changes are worth noting.

Let’s take a closer look at what’s happening and how it could affect your mortgage planning.

Increased Price Cap for Insured Mortgages: A Boost for First-Time Buyers

For first-time buyers, one of the most exciting changes is the increased price cap for insured mortgages. Until now, insured mortgages were capped at $1 million, meaning that any home purchase above that threshold required a minimum down payment of 20%. This was a significant hurdle for homebuyers, particularly in cities where the average home price regularly exceeds $1 million.

With the new rules, the price cap for insured mortgages will increase to $1.5 million. What does this mean for you? Simply put, more homes will be eligible for insured mortgages, allowing buyers to access more favorable financing terms. Homes priced up to $1.5 million may now be purchased with a down payment less than 20%. We are still waiting for confirmation from insurers and lenders on how these new down payment requirements will work in practice.

30-Year Amortization for First-Time Buyers: Lower Monthly Payments

Another game-changing update is the option for first-time homebuyers to extend their amortization period to 30 years. Traditionally, most insured mortgages had a maximum amortization period of 25 years, which meant higher monthly payments for buyers. With a 30-year amortization, first-time buyers will now have more flexibility with their monthly payments, as they can spread their mortgage costs over a longer period.

This is especially helpful for buyers who may find it difficult to qualify for a mortgage under the existing 25-year amortization rules. By opting for a 30-year term, buyers may be able to qualify for a larger mortgage and afford homes that were previously out of reach.

For example:

- A $500,000 mortgage with a 25-year amortization at a 5% interest rate would result in monthly payments of approximately $2,908.

- With a 30-year amortization, those monthly payments drop to about $2,682.

While this longer term offers more manageable payments, it’s important to understand that it also means you’ll pay more interest over the life of your mortgage. It’s crucial to weigh the benefits of lower monthly payments against the higher overall cost of borrowing. This is where consulting with a mortgage expert can be invaluable.

30-Year Amortization for All New Builds: A Boost for the Construction Industry

The 30-year amortization option isn’t just for first-time buyers. Under the new rules, all buyers of new builds will have the option to extend their mortgage term to 30 years, regardless of whether they are purchasing their first home or not. This is fantastic news for anyone looking to invest in a newly constructed home, as it allows for greater flexibility in financing.

This change is also expected to provide a boost to the homebuilding industry, as more buyers may be incentivized to invest in new construction homes. Whether you’re considering a custom-built property or purchasing from a developer, this extended amortization option could make the dream of owning a brand-new home more attainable.

Learn more about mortgage options for new construction homes.

Is a 30-Year Amortization Right for You?

While the idea of spreading mortgage payments over 30 years may sound appealing, it’s essential to evaluate whether this option is the right fit for your financial situation. A longer amortization period means lower monthly payments, which can be a huge advantage for cash flow. However, it also means you’ll end up paying more in interest over the life of the loan.

For instance, the total interest paid on a 30-year mortgage will be significantly higher than on a 25-year mortgage, even if the interest rate remains the same. This is why it’s important to work with a mortgage professional who can help you determine whether a 30-year amortization is the best option for you.

At the end of the day, the decision will depend on your long-term financial goals, your comfort level with debt, and your plans for the property. As your mortgage broker, I’m here to help you navigate these decisions and find the solution that aligns with your goals.

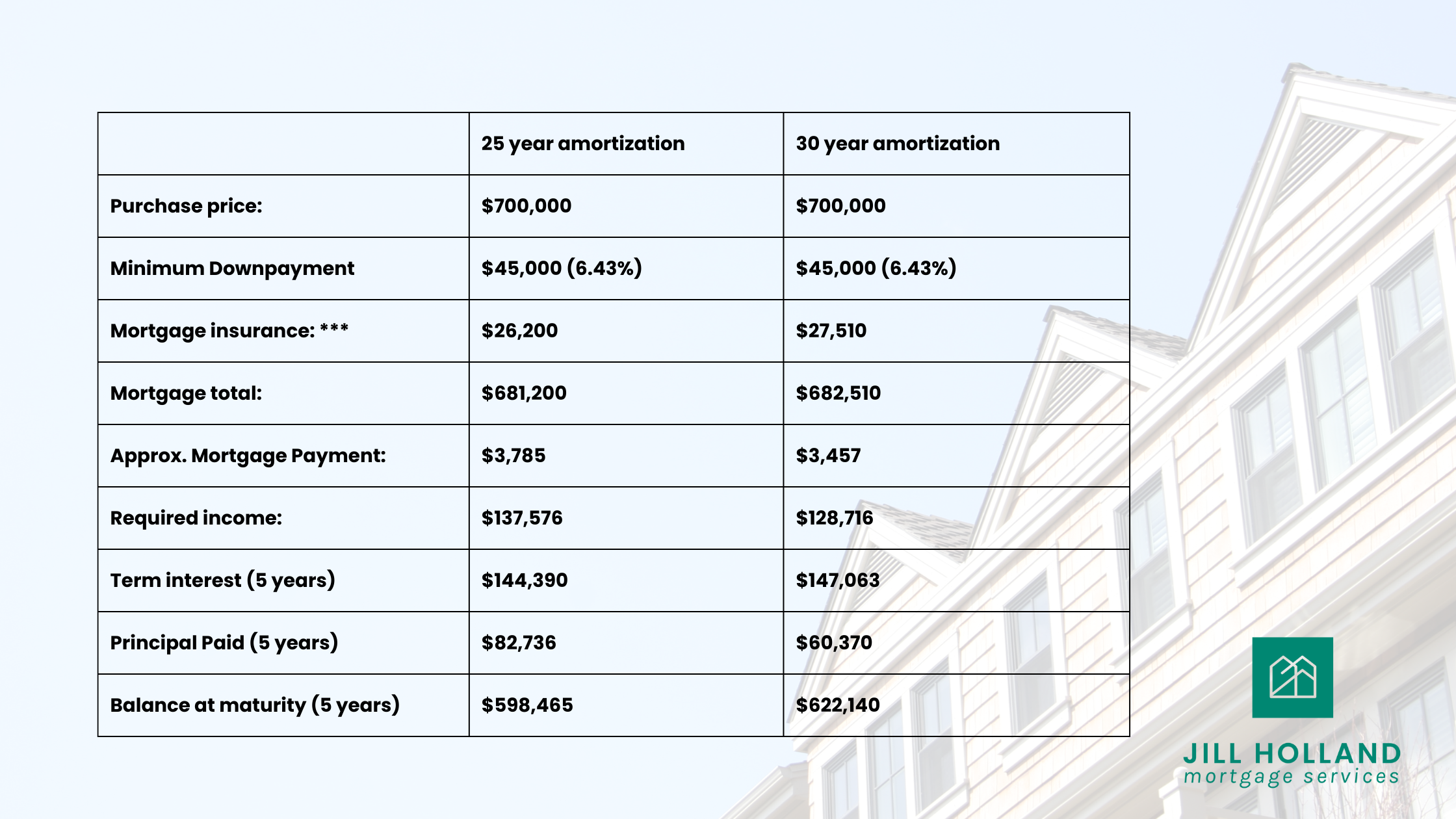

Here is a table comparing 25 year amortization to 30 year amortizations:

The new mortgage rules set to take effect in December 2024 mark an exciting shift in the Canadian housing market. Whether you’re a first-time buyer looking to break into the market or a seasoned homeowner considering a new build, these changes could open up new opportunities for you.

However, with new opportunities come new decisions. It’s essential to stay informed and work with a trusted mortgage professional who can guide you through the process and ensure you make the best choice for your financial future.

If you’re interested in learning more about how these changes might impact your mortgage plans, feel free to reach out! I’d be happy to discuss how these new rules could benefit you and help you secure the home of your dreams.

Jill Holland

Hi, I’m Jill, your mortgage pro. I am here to make the world of mortgages less confusing so you can feel confident in your financial decisions. Through my blog, I aim to provide you with the knowledge and guidance you need to make informed decisions. Your financial peace of mind is my top priority.